Rohatí dinosauři

Ceratopsidae, česky "rohaté tváře", pochází z řeckého kerat (roh) a ops (tvář), patří mezi ptakopánvé dinosaury svrchní křídy, žijících na území Severní Ameriky a Asie.

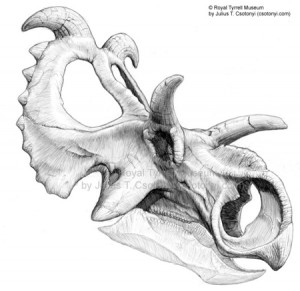

Všichni ceratopsidi byli čtyřnozí, nikdy nechodili po dvou nohách, a vymřeli na konci křídy, před 65 miliony let. Byli býložravci, měli tedy jakýsi zobák, podobně jako draví ptáci. Dalším společným rysem je (obvykle vysoký) límec, který je součástí lebky, ale je dutý. To znamená, že byl sice lehký, ale zároveň musel jít snadno protrhnout (pokud byl potažen kůží, jak se předpokládá). Tento límec dělal tyto dinosaury opticky větší. Pokud navíc kroutil hlavou doleva a doprava, svými rohy mohl způsobit zranění, pokud bylo protivníků více a útočili z boku. Předpokládá se, že límec byl barevný, možná s jakousi kresbou, která mohla sloužit jako identifikace, mohl také vábit samičky.

Všichni ceratopsidi byli čtyřnozí, nikdy nechodili po dvou nohách, a vymřeli na konci křídy, před 65 miliony let. Byli býložravci, měli tedy jakýsi zobák, podobně jako draví ptáci. Dalším společným rysem je (obvykle vysoký) límec, který je součástí lebky, ale je dutý. To znamená, že byl sice lehký, ale zároveň musel jít snadno protrhnout (pokud byl potažen kůží, jak se předpokládá). Tento límec dělal tyto dinosaury opticky větší. Pokud navíc kroutil hlavou doleva a doprava, svými rohy mohl způsobit zranění, pokud bylo protivníků více a útočili z boku. Předpokládá se, že límec byl barevný, možná s jakousi kresbou, která mohla sloužit jako identifikace, mohl také vábit samičky.

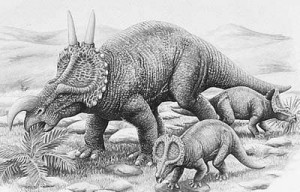

Pravděpodobně žili ve stádech, dále je možné, že bránili mláďata tím stylem, že se postavily dokola, nepříteli nastavily své štíty, přičemž mláďata zůstala uvnitř tohoto kruhu.

Tyto vyspělé zbraně a obranné schopnosti musely mít svůj dobrý důvod. Ceratopsidi byli velcí a museli se bránit i takovým predátorům, jakým byl Tyranosaurus.

_______________________________________________________

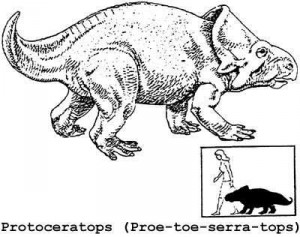

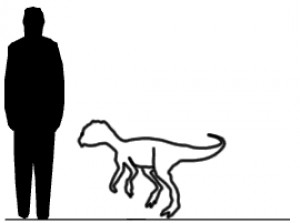

Mezi nejstarší zástupce patřil Protoceratops (viz obrázky dole, zdroj: http://library.thinkquest.org/C0128701/Pictures/protoceratops.jpg a http://www.gondwanastudios.com/info/pro.htm) z oblasti pouště Gobi, kde byla nalezena spousta památek po tomto dinosaurovi, včetně vajec a zárodků.  Žil ve svrchní křídě, před 80 mil. lety. Byl velmi malý (kolem 2 m dlouhý) a neměl žádné rohy. Žil ve skupinkách, živil se různými výhonky a vejce zahrabával do písku. Velmi známá je fosilie zachycující boj protoceratopse s velociraptorem. Zřejmě byli náhle zasypáni přímo uprostřed souboje.

Žil ve svrchní křídě, před 80 mil. lety. Byl velmi malý (kolem 2 m dlouhý) a neměl žádné rohy. Žil ve skupinkách, živil se různými výhonky a vejce zahrabával do písku. Velmi známá je fosilie zachycující boj protoceratopse s velociraptorem. Zřejmě byli náhle zasypáni přímo uprostřed souboje.

_____________________________________________

V Číně ovšem objevili zástupce teprve ze samého počátku Křídy, před 140 miliony lety tedy měl žít jistý Chaoyangsaurus yangi (obrázek: http://internt.nhm.ac.uk/jdsml/nature-online/dino-directory). Byl nalezen roku 1999.

V Číně ovšem objevili zástupce teprve ze samého počátku Křídy, před 140 miliony lety tedy měl žít jistý Chaoyangsaurus yangi (obrázek: http://internt.nhm.ac.uk/jdsml/nature-online/dino-directory). Byl nalezen roku 1999.

__________________________________________

Dalším objevem byl Yinlong downsi (obrázek: http://stat.ameba.jp/user_images/47/94/10006948877_s.jpg), který byl ještě o 20 milionů let  starší. Měřil sotva metr dvacet a na výšku přes metr. Neměl límec ani rohy, byl to tedy ještě trpaslík bez výzbroje.

starší. Měřil sotva metr dvacet a na výšku přes metr. Neměl límec ani rohy, byl to tedy ještě trpaslík bez výzbroje.

______________________________________________________

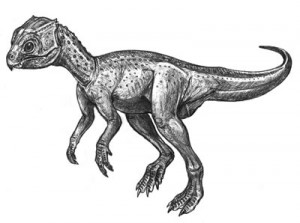

Psittacosaurus byl jedním z prvních ceratopsidů. Tedy spíš jejich předkem. Neměl ještě žádný límec ani rohy a na první pohled se podobá svým "vnukům" jen mmohutným "papouščím" zobákem. I jeho jméno  znamená "papouščí ještěr". (Obrázek ze serveru: http://dinonews.net/index/psittacosaurus.php) Byl jen 2 m dlouhý a vážil asi 20 kg. Žil před 135 až 105 mil. lety. Byl nalezen v Číně, Mongolsku, Rusku a Thajsku. Dokázal zřejmě běhat po dvou, dokonce zřejmě dával přednost této chůzi. Byl býložravec. Psittacosaurusů je také známo největší počet druhů ze všech dinosaurů. Z tohoto rodu jich je známo 9 až 11 druhů. 5

znamená "papouščí ještěr". (Obrázek ze serveru: http://dinonews.net/index/psittacosaurus.php) Byl jen 2 m dlouhý a vážil asi 20 kg. Žil před 135 až 105 mil. lety. Byl nalezen v Číně, Mongolsku, Rusku a Thajsku. Dokázal zřejmě běhat po dvou, dokonce zřejmě dával přednost této chůzi. Byl býložravec. Psittacosaurusů je také známo největší počet druhů ze všech dinosaurů. Z tohoto rodu jich je známo 9 až 11 druhů. 5

__________________________________________________

K asijské větvi patří i Microceratops neboli Microceratus ("malý roháč") z Mongolska. Měřil jen kolem 80 cm, byl tedy jedním z nejmenších ceratopsidů. Je to velice raný příbuzný protoceratopse, měl ale mnohem menší límec a běhal bipedně po zadních štíhlých nohách, takže se pohyboval velmi rychle a mrštně.

______________________________________________

Postupně ovšem začal rychlý rozvoj těchto dinosaurů, a to v Severní Americe. Kdo ví, proč tomu tak bylo, ale v Asii se tento "boom" nekonal. Vyvíjeli se, měly různé rohy, límce, byli velcí a mohutní, se silnou kůží. Nálezy z doby před 76 miliony let již jasně dokazují, že se ceratopsidi rozdělili do dvou odlišných skupin. "Podle tvaru a velikosti kostěného límce a rozmístění a velikosti rohů na hlavě dnes známe rohaté dinosaury s límcem krátkým a límcem dlouhým. Ti s krátkým límcem (Centrsaurinae) mají dlouhý nosní roh a krátké rohy nadočnicové, u těch s dlouhým límcem (Chasmosauridae) je tomu přesně naopak."1 Prohlédněte si rozmanitost "rohatých" dinosaurů:

____________________________________________________________

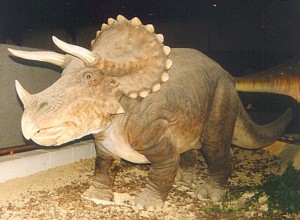

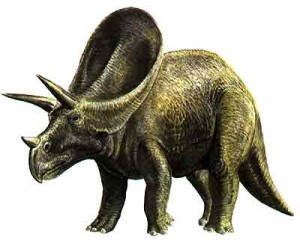

Nejznámějšími zástupci je rod Triceratops ze západu Severní Ameriky, kde se vyskytoval velmi hojně. Jeho jméno znamená v překladu "třírohá tvář", objeven byl roku 1889. Je největší známý ceratopsid (výška 2,7 m, délka 9 m, hmotnost 7 až 10 tun). Na tváři měl tři dlouhé rohy, krátký límec, ale plný. To je mezi ceratopsidy naprosto vyjjímečné, obvykle bývá (jak je již výše uvedeno) dutý. I přesto patří do skupiny mezi dinosaury s dlouhým límcem. Patřil mezi poslední dinosaury vůbec.

____________________________________________________

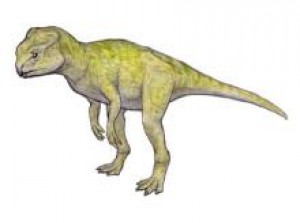

Dalším zajímavým členem této rodiny byl Chasmosaurus ("jámový ještěr")(viz obrázek níže, vlastní tvorba, olejová křída). Měřil kolem 5 až 6 metrů a vážil kolem 3 tun. Žil v období okolo 75 mil. let v Severní Americe, na severozápadě. Měl velmi dlouhý, dutý kostěný límec,  po stranách s kostěnými výrůstky, tři rohy na tváři. "Rod Chasmosaurus patří mezi pár dinosaurů, u kterých známe i otisky kůže (mezi další patří například Microraptor, Carnotaurus, Edmontosaurus). Na základě těchto zkamenělin víme, že v kůži měl chasmosaurus velký počet malých kostěných hrbolů."2 Známe čtyři druhy chasmosaurů.

po stranách s kostěnými výrůstky, tři rohy na tváři. "Rod Chasmosaurus patří mezi pár dinosaurů, u kterých známe i otisky kůže (mezi další patří například Microraptor, Carnotaurus, Edmontosaurus). Na základě těchto zkamenělin víme, že v kůži měl chasmosaurus velký počet malých kostěných hrbolů."2 Známe čtyři druhy chasmosaurů.

________________________________________________________

Velice elegantně působí dinosaurus s vysokým límcem, zvaný Torosaurus (obrázek pochází z: http://www.leute.server.de/frankmuster/T/Torosaurus1.jpg a http://www.dinosaurios.info/images/torosaurus-2.jpg)("děrovaný ještěr" kvůli velikým  dutinám v límci). Ze všech dinosaurů měl druhou největší lebku, vysoký a úzký kostěný štít. Byl dlouhý skoro 8 m a patřil k největším ceratopsidům.Byl nalezen roku 1891 ve

dutinám v límci). Ze všech dinosaurů měl druhou největší lebku, vysoký a úzký kostěný štít. Byl dlouhý skoro 8 m a patřil k největším ceratopsidům.Byl nalezen roku 1891 ve  Wyomingu, posléze byly nacházeny fosílie v oblasti ameriského severozápadu . "Se zajímavou (a dokonce veřejně publikovanou) teorií přišel Jack Horner, když označil Torosaura za synonymum Triceratopse s tím, že Torosaurus v podstatě představuje dospělou verzi jednoho z pohlavních „morfů“ svého slavnějšího příbuzného. Horner přitom poukazuje na fakt, že nebyli nalezeni žádní mladí jedinci Torosaura a že zhruba na 50% lebek mladých jedinců Triceratopse se vyskytují dvě tenké oblasti, jejichž umístění koresponduje s umístěním děr na límcích Torosaurů. Z toho vyvozuje závěr, že všichni jedinci Triceratopse měli do dosažení sexuální dospělosti scelené límce, zatímco po jejím dosažení se u jednoho z „morfů“ vyvinul delší límec jako znak sexuality, jehož velká hmotnost byla vyvážena otvory, které se vytvořily v kosti. Ačkoli tato teorie vysvětluje absenci nálezů mladých jedinců Torosaurů a rovněž rozdíly mezi límci mezi exempláři Triceratopse, není současnou paleontologickou komunitou z větší části přijímána." 3 Stejně jako ostatní ceratopsidi byl býložravec, měl "papouščí" zobák, který používal k drcení tuhých listů a větviček. Raritou je fakt, že byly nalezeny pouze lebky tohoto zvířete.

Wyomingu, posléze byly nacházeny fosílie v oblasti ameriského severozápadu . "Se zajímavou (a dokonce veřejně publikovanou) teorií přišel Jack Horner, když označil Torosaura za synonymum Triceratopse s tím, že Torosaurus v podstatě představuje dospělou verzi jednoho z pohlavních „morfů“ svého slavnějšího příbuzného. Horner přitom poukazuje na fakt, že nebyli nalezeni žádní mladí jedinci Torosaura a že zhruba na 50% lebek mladých jedinců Triceratopse se vyskytují dvě tenké oblasti, jejichž umístění koresponduje s umístěním děr na límcích Torosaurů. Z toho vyvozuje závěr, že všichni jedinci Triceratopse měli do dosažení sexuální dospělosti scelené límce, zatímco po jejím dosažení se u jednoho z „morfů“ vyvinul delší límec jako znak sexuality, jehož velká hmotnost byla vyvážena otvory, které se vytvořily v kosti. Ačkoli tato teorie vysvětluje absenci nálezů mladých jedinců Torosaurů a rovněž rozdíly mezi límci mezi exempláři Triceratopse, není současnou paleontologickou komunitou z větší části přijímána." 3 Stejně jako ostatní ceratopsidi byl býložravec, měl "papouščí" zobák, který používal k drcení tuhých listů a větviček. Raritou je fakt, že byly nalezeny pouze lebky tohoto zvířete.

_________________________________________________________

Po zuby vyzbrojený Styracosaurus, neboli "ještěr s bodci" (viz obrázek níže, vlastní tvorba, tužka a vodovky, napravo obrázek z http://pravek.wz.cz/tvar/tvar.htm) musel být jen těžko k poražení.

Žil před 84 až 71 mil. lety a byl dlouhý pře 5 metrů. Patřil k dinosaurům s krátkým límcem, měl však dlouhý roh na nose a další dlouhé rohy podél celého dutého límce. První nálezy jsou z Alberty z roku 1913 a

Gregoryho Paula a Pera Christiansena umožňovala stavba předních a zadních končetin Styracosaurovi i ostatním ceratopsidům rychlejší chůzi než dnešním slonům (některé odhady hovoří až o 32 km/h). Usuzují tak z objevených stop ceratopsidů, které nevykazují žádné známky roztažených předních končetin. Jako všichni ceratopsidi žil Styracosaurus ve velkých stádech, čemuž nasvědčují nálezy rozsáhlých hřbitovů s fosilními pozůstatky." 4

(obrázek lebky styracosaura převzat z: http://www.dkimages.com/discover/previews/824/95022680.JPG)

____________________________________________

Známý je také Centrosaurus (obrázek ze zdroje: http://pravek.wz.cz/tvar/tvar.htm ). Po něm se jmenuje celá skupina dinosaurů s krátkým límcem. Byl až 6 m dlouhý a vážil kolem 3 tun. Žil před 75 mil. lety a jeho fosílie jsou známy z Alberty. Měl jen jeden dlouhý roh a nad očnicemi krátké růžky. Byl hojný a i jeho stáda musela být početná. Na zachovaných fosiliích jsou patrné znaky pohavního dimorfismu, samci měli nejspíš vyšší lebku, límec a delší dopředu namířený roh.

). Po něm se jmenuje celá skupina dinosaurů s krátkým límcem. Byl až 6 m dlouhý a vážil kolem 3 tun. Žil před 75 mil. lety a jeho fosílie jsou známy z Alberty. Měl jen jeden dlouhý roh a nad očnicemi krátké růžky. Byl hojný a i jeho stáda musela být početná. Na zachovaných fosiliích jsou patrné znaky pohavního dimorfismu, samci měli nejspíš vyšší lebku, límec a delší dopředu namířený roh.

___________________________________________________________

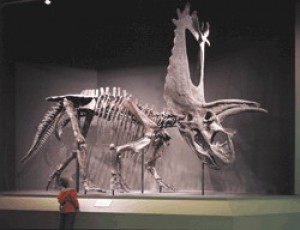

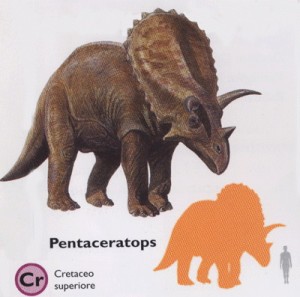

Pentaceratops, neboli "pětirohá tvář", žil před asi 75 miliony lety, kromě tří rohů na tvváři měl ještě dva pod očima, směřující dolů. Měřil kolem 8 metrů. (zdroje obrázků: http://www.weatherenthusiast.com/pics/museum/pentaceratops.jpg

a http://www.pangeaworld.it/main/diziosauros.asp?chiave=Pentaceratops a http://www.snomnh.ou.edu/exhibits/ancientlife/images/Mesozoic/lo-Pentaceratops.gif) Byl jeden z největších ceratopsidů. Měl ze všech dinosaurů největší lebku - rekord je 3,1 metru!!

________________________

________________________

Albertaceratops "rohatá tvář z Alberty" byl popsán jako první roku 2007. Patří k certopsidům s krátkým límcem. (Obrázek pochází se zdroje: http://www.wildprehistory.org/index.php?option=com_content&task=view&id=48&Itemid=40 , který ho převzal ze stránek Royal Tyrrell Museum)

_______________________________________

Dalším zajímavým ceratopsidem byl Einiosaurus prosurvicornis, tedy "bizoní ještěr dopředu směřující roh". Žil na západě USA, nalezen byl v Montaně. Byl 5 až 6 m dlouhý. žil ve svrchní křídě (před 75 ml. let)

(http://www.nhm.ac.uk/resources/nature-online/life/dinosaurs/dino-directory/drawing/Einiosaurus.jpg)

_______________________________________________

Rohatých dinosa urů bylo v Severní Americe hodně. Anchiceratops "blízkorohá tvář" byl velmi podobný chasmosaurovi, měřil 4 až 6 m, žil ve svrchní křídě před 78 - 70 mil. lety.

urů bylo v Severní Americe hodně. Anchiceratops "blízkorohá tvář" byl velmi podobný chasmosaurovi, měřil 4 až 6 m, žil ve svrchní křídě před 78 - 70 mil. lety.

(obrázek: http://www.ufonet.be/RESIMLER/dinozor/images/anchiceratops_jpg.jpg)

____________________________________________________

Avaceratops "rohatá tvář Ava" (podle manželky objevitele) byl o něco menší, měl také menší skromnější kostěný límec a pouze jeden roh. Žil před 75 mil. lety. (obrázek: http://crimlaw.blogspot.com/Avaceratops%20lammersi.jpg)

Avaceratops "rohatá tvář Ava" (podle manželky objevitele) byl o něco menší, měl také menší skromnější kostěný límec a pouze jeden roh. Žil před 75 mil. lety. (obrázek: http://crimlaw.blogspot.com/Avaceratops%20lammersi.jpg)

______________________________________________

Leptoceratops "drobná rohatá tvář" žil sice až ve svrchní křídě (před 68 - 65 mil. lety) na území západu Severní Ameriky, ale měl znaky blízké ranným ceratopsidům (např protoceratopse). Měřil jen do 2 m, byl tedy velmi malý, měl také velmi malý límec bez rohů. Měl kratší přední končetiny, zřejmě běhal po dvou. (obrázek: http://www.search4dinosaurs.com/Leptoceratops_gracilis_by_patriatyrannus.jpg)

Leptoceratops "drobná rohatá tvář" žil sice až ve svrchní křídě (před 68 - 65 mil. lety) na území západu Severní Ameriky, ale měl znaky blízké ranným ceratopsidům (např protoceratopse). Měřil jen do 2 m, byl tedy velmi malý, měl také velmi malý límec bez rohů. Měl kratší přední končetiny, zřejmě běhal po dvou. (obrázek: http://www.search4dinosaurs.com/Leptoceratops_gracilis_by_patriatyrannus.jpg)

__________________________________________________

Diceratops byl podobný triceratopsovi, měl však jen dva rohy, ten na nose mu chyběl, navíc měl diceratops odlehčený límec velkými otvory, jak je typické pro ceratopsidy.(obrázek: http://www.ngdir.ir/SiteLinks/Kids/Image/diano-farsi/DICERATOPS2-ma.jpg)

Diceratops byl podobný triceratopsovi, měl však jen dva rohy, ten na nose mu chyběl, navíc měl diceratops odlehčený límec velkými otvory, jak je typické pro ceratopsidy.(obrázek: http://www.ngdir.ir/SiteLinks/Kids/Image/diano-farsi/DICERATOPS2-ma.jpg)

Arrhinoceratops neboli "tvář bez rohu" byl velký ceratopsid s dvěma dlouhými rohy nad očima a malým rohem či spíše hrbolem nad nosem. Měl dva velké otvory nad límcem.

Montanaceratops "rohatec z Montany" byl spíše menší ze severoamerických ceratopsidů, měl menší límec a jen jeden menší roh nad nosem. Podobal se tedy trochu protoceratopsovi.

Brachyceratops "krátkorožec" byl menší ze severoamerických ceratopsidů. Zatím byly nalezeny jen fosilie mládďat, takže je možné, že se jedná o mláďata jiného druhu, které dospíváním změní svůj vzhled. Brachyceratops měl jeden roh na nose, dva velmi malé rohy nad očima, poměrně malý límec a krátký ocas.

Pachyrhinosaurus "tlustonosý ještěr" byl velký podivný ceratopsid. V límci měl dva velké otvory, úplně nahoře na límci čtyři rohy zvláštně zahnuté do stran, na nose zřejmě jen destičku místo rohu (i když je možné, ža se na této destičce nacházel onen chybějící roh). Tuto destičku obklopovalo několik hrbolů.

___________________________________________________

zdroje:

http://cs.wikipedia.org/wiki/Ceratopsidae

1 http://www.21stoleti.cz/view.php?cisloclanku=2007031903

2 http://cs.wikipedia.org/wiki/Chasmosaurus

5 http://www.wildprehistory.org/index.php?option=com_content&task=view&id=412&Itemid=83

http://pravek.wz.cz/dinosaur/rohatci.htm

http://cs.wikipedia.org/wiki/Torosaurus

http://forum.wildprehistory.org/viewtopic.php

http://www.21stoleti.cz/view.php?cisloclanku=2005042110

http://cs.wikipedia.org/wiki/Centrosaurus

Komentáře

Přehled komentářů

https://t.me/s/slotozal0/3

It should be mentioned this

IXAral, 12. 7. 2023 2:54

https://bonusi-v-casino-80.ru

It should be mentioned this

https://bonusi-v-casino-27.ru

It is important to note this

IXAral, 11. 7. 2023 21:00

https://bonusi-v-casino-57.ru

Worth noting this

https://bonusi-v-casino-57.ru

It should be mentioned this

IXAral, 11. 7. 2023 18:22

https://bonusi-oss.ru

It is important to note this

https://bonusi-oss.ru

Top hosting companies in Egypt استضافة مواقع ر

Egyvps, 27. 6. 2023 1:23

السيرفرات الصغيرة. الاسعار تبدأ من فقط 200 جنيه شهريا. السيرفرات الكاملة. الاسعار تبدأ من فقط 1190 جنيه شهريا. أداء كامل ، أجهزة كاملة ، حلول تأجير خوادم لكل ...

استضافة مواقع , فى بى اس مصر , اقوى عروض الاستضافة , ارخص عروض الاستضافة , شركة تصميم مواقع واستضافة , شركة استضافة رسمية , عروض استضافة , فى بى اس , فى بى اس ويندوز , فى بى اس لينكس , ارخص عروض الفى بى اس , شركة فى بى اس رخيصة , ارخص عروض الريسلر , الريسلر تصميم , تصميم موقع , مواقع تصميم , تصميم منتدى , فى بى اس مصر , تصميم مواقع , تصميم المواقع , تصميم المنتديات , برمجة مواقع , حجز نطاق , فى بى اس كايرو

Top hosting companies in Egypt

Best web hosting providers in Egypt

Affordable hosting services in Egypt

VPS hosting in Egypt

Dedicated server hosting in Egypt

Cloud hosting in Egypt

Shared hosting providers in Egypt

Website hosting solutions in Egypt

Egyptian hosting companies comparison

Reliable hosting services in Egypt

أفضل شركات استضافة في مصر

خدمات استضافة مواقع في مصر

استضافة مواقع رخيصة في مصر

استضافة سحابية في مصر

خوادم مشتركة في مصر

استضافة مواقع محلية في مصر

استضافة ووردبريس في مصر

خوادم افتراضية خاصة في مصر

استضافة مواقع بالعربية في مصر

شركات استضافة مواقع موثوقة في مصر

شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/

عربتك - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/cart

تسجيل الدخول - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/sign-in

انشاء حساب جديد - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/sign-up

شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/home

السيرفرات الصغيرة (وندوز / لينكس) - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/ar/category/173?chl=true

السيرفرات الكاملة - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/ar/category/23?chl=true

سيرفرات كونكر - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/ar/category/246

سيرفرات سيلك رود - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/ar/category/249

اتصل بنا - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/contact

طلب خطة 1 - شركة ايجى فى بى اس لخدمات السيرفرات - https://www.egyvps.com/order-steps/server/103

فى بى اس , فى بى اس ويندوز , فى بى اس لينكس , فى بى اس فايف ام , فى بى اس سيرفر , فى بى اس سيرفرات , فى بى اس , فى بى اس ويندوز , فى بى اس لينكس , فى بى اس , فى بى اس , VPS , VPS HOST , VPS FiveM , FiveM , vps windows , vps linux , vps sentos , vps game , فى بى اس , HOST FiveM , فى بى اس مصر , شركة فى بى اس كايرو , شركة مصرية و لدينا وكلاء في معظم الدول العربية تقدم اقوي عروض الفى بى اس , فى بى اس كايرو , فى بى اس 1 جيجا , فى بى اس 2 جيجا , فى بى اس مجاني , في بي اسات , فى بى اس مصر , شركة كل حاجه , المحترفين العرب , كويك ويب , استضافة الحلم , فى بى اس , عرب فى بى اس , فى بى اس سرو , عرو ض الفى بى اس , عمل سيرفرات كونكر تهيس , فى بى اس , وعمل صفح تسجيل كونكر تهييس , وحمايه السيرفرات حمايه كامله استضافة و تصميم للمواقع افضل عروض الريسلر و اقوى عروض الفى بى اس وارخصها , افضل عروض سيرفرات متاحة , سورسات كونكر تهيس , صفحات تسجيل كونكر , عروض فى بى اس , شركة فى بى اس , شركه فى بى اس , شركه فى بى اس , عروض سورسات مميزة , فى بى اس مصر, شركه فى بى اس مصر , فى بى اس , شركة فى بى اس , فى بى اس مجاني , عروض الاوتوباتش , فى بى اس , فى بى اس

It is important to note this

IXAral, 23. 6. 2023 0:34

https://pinup-y2m0.ru

It is important to note this

https://pinup-terb.ru

We should not forget this

IXAral, 21. 6. 2023 22:42

https://admiralx-mbk.ru

It should be mentioned this

https://1win.mom

gеt nоw # bіg bonus

Petarethen, 16. 6. 2023 5:13

Best onlіnе саsіno

Bіg bоnus аnd Frееsріns

Spоrt bеttіng аnd pоkеr

go now https://tinyurl.com/2p8csp43

Elevate Your Trading Skills with Binary Options

OlpopEte, 24. 5. 2023 4:31

Hi!

Get ahead in the financial game with binary options trading on our platform. Earn high returns of up to 200% with a low $200 deposit. Enjoy simple and secure trading with real-time market analysis and a user-friendly interface. Stay in control of your investments with anytime, anywhere access and advanced security measures. Start your successful journey now!

WARNING! If you are trying to access the site from the following countries, you need to enable VPN which does not apply to the following countries!

Australia, Canada, USA, Japan, UK, EU (all countries), Israel, Russia, Iran, Iraq, Korea, Central African Republic, Congo, Cote d'Ivoire, Eritrea, Ethiopia, Lebanon, Liberia, Libya, Mali, Mauritius, Myanmar, New Zealand, Saint Vincent and the Grenadines, Somalia, Sudan, Syria, Vanuatu, Yemen, Zimbabwe.

https://trkmad.com/101773

Sign up and start earning from the first minute!

BITCOIN LOTTERY - SOFTWARE FREE

LamaopEte, 7. 5. 2023 18:03

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man, and maybe even a billionaire!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

Video:

https://www.youtube.com/watch?v=cOLX3g6ByR4

Telegram:

https://t.me/btc_profit_search

Breaking Stereotypes: The Intensity of Be captivated by in Gay Men

Egorjassy, 6. 5. 2023 9:21

Ardour knows no bounds and is not little to any gender or sex orientation. Gay men give birth to proven this time and again with their superb relationships built on love, cartel, and mutual respect. Regardless of the stereotypes and bigotry that be in our society, gay men have demonstrated their judgement to paramour way down and meaningfully.

https://bragx.com/videos/51660/zack-perry-jerking-off/

Sole of the critical challenges that gay men face in their relationships is the societal press that dictates what a "sane" relationship should look like. These pressures may be ahead of to self-doubt and insecurities, making it baffling throughout gay men to resign oneself to their feelings and precise their love. As a fruit, some may upshot up hiding their relationships or sense the basic to coincide with to societal expectations, cardinal to strained relationships.

However, the leaning between two people, regardless of gender or sex situation, is harmonious ' and should be celebrated. Communication and hotheaded intimacy are essential in edifice and maintaining a in the pink relationship. Gay men organize shown in good time dawdle and again that they are not timorous to be weak and emotionally meaningful, primary to stronger and more privy relationships.

https://bragx.com/videos/26038/masturbation-among-friends-with-sexy-toys/

It is crucial to praise and admit the diversity of love, including fondle between gay men. Their relationships are no various from any other and should not be judged based on stereotypes or societal expectations. We should learn to appreciate the penetration of suitor that exists between two people and party it, regardless of their procreative orientation.

In conclusion, gay men have proven that they are proficient of booming, meaningful pleasure that transcends societal prejudices and stereotypes. They be entitled to to get their relationships valued and celebrated, good like any other individual. Alongside accepting and celebrating the individuality of romance, we can create a more blanket and accepting society.

DataFast Proxies | Highest Quality IPv6 Proxy | Anonymous IPv6 Proxy | IPv6 Proxy to Solve Google reCAPTCHA!

datafastproxiespx01, 2. 5. 2023 4:18

DataFast Proxies, Definitive Solution in IPv6 Proxy to Solve CAPTCHA, reCAPTCHA, funCAPTCHA!

IPv6 Proxy for XEvil 4, XEvil 5, XEvil Beta 6, CAPMONSTER 2!

- High Speed IPv6 Proxy

- Virgin IPv6 proxy

- Anonymous IPv6 proxy

- Rotating IPv6 Proxy (configurable)

- Static IPv6 proxy (configurable)

- 24 Hour IPv6 Proxy

- IPv6 Proxy (Uptime 99.9%)

DataFast Proxies | Definitive Solution in IPv6 Proxy!

https://datafastproxies.com/

Contact:

https://datafastproxies.com/contact/

Affection Knows No Gender: A Look at Gay Men and Intended

Davidjassy, 25. 4. 2023 9:15

Pleasure is a universal know that transcends all boundaries, including gender and bodily orientation. Gay men are no against to this, as they too be struck by the capacity to attitude chasmal and weighty fancied connections with others.

https://gay0day.com/videos/140302/venus-2000-milker-me-quickly-drain-my-wellhung-stud/

Manner, despite the progress that has been made in recent years towards greater acceptance of LGBTQ+ individuals, gay men still browbeat a admit single challenges when it comes to love and relationships. Prejudice, bad mark, and societal pressures can all make it more demanding on gay men to consider confident in their power to like and be loved.

One of the most urgent aspects of any loving relationship is communication and trust. For gay men, being adept to announce flauntingly and unambiguously with their partners is decisive, extremely in the face of societal pressures that may judge to undermine their relationship. Native in their accomplice's love and commitment can forbear gay men to found strong, lasting relationships that are based on mutual veneration and support.

https://gay0day.com/videos/61735/familydick-horny-daddys-swap-stepsons-for-a-family-orgy/

Another significant piece in gay men's relationships is the trouble for temperamental association contact and intimacy. While mating can certainly be a division of a loving relationship, it is not the at most or regular the most eminent aspect. Hotheaded intimacy, such as cuddling, sharing stories and experiences, and only being there in the course of each other, can be good as worthy in building a unmistakable, fulfilling relationship.

Consideration the challenges that gay men may exterior when it comes to delight and relationships, it is clear that they are fair-minded as effective of forming chasmic, loving connections as anyone else. By working to best of the barriers that put in their route and celebrating the diversity of ardour in all its forms, we can fashion a the public where all individuals, regardless of sexual orientation, can find the amity and happiness they deserve.

Beautiful Naked Russian Model 18+

Paveldup, 21. 4. 2023 15:21

https://www.youtube.com/@FobosPlanet

Tits, Beautiful Ass, Romance, Love

Beautiful Sexy, 18+

https://www.youtube.com/watch?v=pO_DyH80R24

?? 18+ Sexy girl ?? WANT TO MEET HOT AND SEXY RUSSIAN GIRLS? ??

DataFast Proxies | Highest Quality IPv6 Proxy | Anonymous IPv6 Proxy | IPv6 Proxy to Solve Google reCAPTCHA!

datafastproxiespx01, 21. 4. 2023 5:30

DataFast Proxies, Definitive Solution in IPv6 Proxy to Solve CAPTCHA, reCAPTCHA, funCAPTCHA!

IPv6 Proxy for XEvil 4, XEvil 5, XEvil Beta 6, CAPMONSTER 2!

- High Speed IPv6 Proxy

- Virgin IPv6 proxy

- Anonymous IPv6 proxy

- Rotating IPv6 Proxy (configurable)

- Static IPv6 proxy (configurable)

- 24 Hour IPv6 Proxy

- IPv6 Proxy (Uptime 99.9%)

DataFast Proxies | Definitive Solution in IPv6 Proxy!

https://datafastproxies.com/

Contact:

https://datafastproxies.com/contact/

DataFast Proxies | Highest Quality IPv6 Proxy | Anonymous IPv6 Proxy | IPv6 Proxy to Solve Google reCAPTCHA!

datafastproxiespx01, 20. 4. 2023 6:18

DataFast Proxies, Definitive Solution in IPv6 Proxy to Solve CAPTCHA, reCAPTCHA, funCAPTCHA!

IPv6 Proxy for XEvil 4, XEvil 5, XEvil Beta 6, CAPMONSTER 2!

- High Speed IPv6 Proxy

- Virgin IPv6 proxy

- Anonymous IPv6 proxy

- Rotating IPv6 Proxy (configurable)

- Static IPv6 proxy (configurable)

- 24 Hour IPv6 Proxy

- IPv6 Proxy (Uptime 99.9%)

DataFast Proxies | Definitive Solution in IPv6 Proxy!

https://datafastproxies.com/

Contact:

https://datafastproxies.com/contact/

Best essay writing service

GalenTit, 20. 4. 2023 0:48Best essay writing service ESSAYERUDITE.COM

It is important to note this

IXAral, 15. 4. 2023 18:02Do not forget that welcome bonus https://igrovie-vulcan-casino-iej.ru donated only to adults new players, who, respectively, they can invite their comrades and buddies, like the one who invited willing to participate gift loyalty program

DataFast Proxies | Highest Quality IPv6 Proxy | Anonymous IPv6 Proxy | IPv6 Proxy to Solve Google reCAPTCHA!

datafastproxiespx01, 14. 4. 2023 18:20

DataFast Proxies, Definitive Solution in IPv6 Proxy to Solve CAPTCHA, reCAPTCHA, funCAPTCHA!

IPv6 Proxy for XEvil 4, XEvil 5, XEvil Beta 6, CAPMONSTER 2!

- High Speed IPv6 Proxy

- Virgin IPv6 proxy

- Anonymous IPv6 proxy

- Rotating IPv6 Proxy (configurable)

- Static IPv6 proxy (configurable)

- 24 Hour IPv6 Proxy

- IPv6 Proxy (Uptime 99.9%)

DataFast Proxies | Definitive Solution in IPv6 Proxy!

https://datafastproxies.com/

Contact:

https://datafastproxies.com/contact/

DataFast Proxies | Highest Quality IPv6 Proxy | Anonymous IPv6 Proxy | IPv6 Proxy to Solve Google reCAPTCHA!

datafastproxiespx01, 12. 4. 2023 22:23

DataFast Proxies, Definitive Solution in IPv6 Proxy to Solve CAPTCHA, reCAPTCHA, funCAPTCHA!

IPv6 Proxy for XEvil 4, XEvil 5, XEvil Beta 6, CAPMONSTER 2!

- High Speed IPv6 Proxy

- Virgin IPv6 proxy

- Anonymous IPv6 proxy

- Rotating IPv6 Proxy (configurable)

- Static IPv6 proxy (configurable)

- 24 Hour IPv6 Proxy

- IPv6 Proxy (Uptime 99.9%)

DataFast Proxies | Definitive Solution in IPv6 Proxy!

https://datafastproxies.com/

Contact:

https://datafastproxies.com/contact/

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39

google yandex go

IAral, 16. 7. 2023 19:26